Tax

Business Analyst’s Travel Expenses Denied by the ATO

In relation to claiming work related expenses here is an ATO example of how a taxpayer came unstuck in claiming travel expenses as a deduction.

A business analyst who travelled between Shanghai and Australia for work claimed over $46,000 in travel expenses. When asked to substantiate his claim, the analyst produced receipts for rent, meals, laundry, phone, taxi, and train travel expenses while in Shanghai.

When the ATO contacted the employer, they were advised that this employee was reimbursed for the costs of all his meals, accommodation and travel expenses. Because the employee had been reimbursed they were not entitled to then claim them as a deduction for tax purposes. On this basis, the analyst’s claims were disallowed by the ATO.

If it is unclear if an expense is an expense for tax purposes or you just want to make sure, call Balanix Solutions today on (07) 3264 4783 for expert advice.

Can You Claim Travel to Your Rental Property?

A commonly asked question is whether you are able to claim travel costs to inspect a property you may be interested in buying. The answer is no, even if you do in fact go ahead and buy the property. So, if a promoter suggests these costs are deductible as a means of getting you to look at a property, don’t get caught but this claim. Similarly, costs of attending rental seminars (including travel), to help you locate a suitable rental property are also not deductible. These costs would be deductible only where you can demonstrate they relate to producing income from the property.

However, you can claim the cost of travel once you own a rental property which would include the kilometres driven from your home to the rental home and back.

ATO Example: Claimable car expenses

Claire inspects her rental property three months after the tenants move in. she also makes a number of visits to the property during the year to carry out minor repairs. Claire travels 162 kilometres during the course of these visits in her car. Claire works out her car expenses using the cents per kilometre method and claims the following deduction:

Distance travelled x rate per kilometre = deductible amount

162 km x 66 cents per kilometre = $107

Claire can only claim this deduction for travel expenses associated with her rental property – she cannot also claim the expense at the work-related car expenses label (D1) on her tax return. If she wants to make a separate work-related car expenses claim, the total distance she travelled on income-producing activities (including rental property travel expenses) cannot exceed 5,000 kilometres when using the cents per kilometre method.

Note in the example above Claire was the owner of the rental property and therefore able to claim the costs of travelling to the rental property and the travel was after she purchased the property. The ATO example below looks at the case where the husband who is not the owner of the rental property does the travelling and repairs. In this case he cannot claim the deduction as he is not the owner nor can Kei as she did undertake the travel.

ATO Example: Ownership interest

Kei is the sole owner of a rental property. Her husband, Bert, occasionally drives to the rental property in his own car to undertake maintenance. As he has no ownership interest in the property, Bert cannot claim travel expenses. Similarly, since Kei did not travel to the property to undertake the maintenance, she cannot claim a deduction.

If Kei and Bert co-owned the property, Bert could share his travel expenses with Kei in line with their legal interest in the property.

If the distance was such that it required an overnight stay then the costs of accommodation and meals would also be claimable.

So you would be able to claim the costs of travel to your rental property if:

- you own a rental property that is far away from where you live

- it would be unreasonable to expect you not to stay near the rental property overnight when making an inspection

- your main purpose in travelling was to inspect and maintain the rental property.

Where you stay overnight, you can claim meals and accommodation. However, if for example your rental property was interstate and for example you fly to where the rental property is located and had a holiday there while inspecting the property you would need to apportion the costs.

ATO Example: Apportionment

Bill and Marli King are joint owners of a rental property in a resort town on the north coast of Queensland. They spend $1,800 on airfares and $1,500 on accommodation when they travel from their home in Melbourne, mainly for the purpose of holidaying in the resort town, but also to inspect the property. They also spend $100 on taxi fares from the hotel to the rental property and back. The Kings spent:

- one day (10% of their total time in Queensland) on matters relating to the rental property

- nine days (90% of their total time in Queensland) swimming and sightseeing.

They cannot claim a deduction for any part of the $1,800 airfares because the main purpose of the trip is a holiday and the property inspection is incidental. If the trip included a significant amount of time devoted to the rental property, they could apportion some of the airfares.

They can claim deductions for the $100 taxi fare and a reasonable apportionment of the accommodation expenses (that is $150 of the $1,500). Their total claim is $250. As the Kings jointly own the rental property, they can claim $125 each.

ATO Example: Accommodation

Jabari is the sole owner of a rental property on the Gold Coast. He travels from Sydney to the Gold Coast to undertake deductible repairs on his rental property but takes his spouse, Kym, with him for company and to share the driving. Jabari and Kym stay in a hotel where the cost of a:

- single room is $55

- double room is $70.

A reasonable basis for apportionment of accommodation expenses in this instance is to claim the single room rate of $55 (rather than half the double room rate), as Jabari would have stayed in the single room if Kym had not travelled with him.

ATO Data Matching Programs

The Australian Taxation Office (ATO) has announced that it is embarking on three major program:

- Share transactions data matching program;

- Credit and debit card data matching program; and

- Online selling data matching program.

All of these programs are about the ATO collecting data that the ATO will be able to use to cross check with other data to ensure that taxpayers are complying with their obligations under the various tax legislation.

In relation to the share transaction, the ATO will be collecting data as far back as 20 September1985 which will assist the ATO in determining the cost base of shares and the capital proceeds from sales of shares. It is Balanix Solutions’ experience that people often do not keep such information as to when they purchased shares which means that significant time is spent piecing together this information in many instances at a not insignificant cost to the client.

This gets even more complicated where companies are either taken over or merged with other companies and shares in the old company are paid for by shares in the new company.

The second program will provide data relating to the credit and debit card payments to merchants and cover off on the 2015/2016 and 2016/2017 financial years. This program will include all the major banks, as well as, the likes of American Express and Dinners Club.

The last of the three programs will be collecting data relating to online selling where registrants have sold goods and services to an annual value of $12,000 or more. This program will be targeting those individuals not declaring some or all of their income from online selling and those individuals who are in fact running a business from online selling but not complying with the various pieces of legislation relating to registering a business and the carrying on of a business e.g GST.

If you have any concerns in relation to whether these programs may impact upon you personally or your business, call Balanix Solutions on 07 3264-4783 to discuss your individual circumstances.

ATO to Disclose Tax Debt Information to Credit Reporting Organisations

Not effectively engaged with the Australian Taxation Office (ATO) to manage ATO debts? From 1 July 2017, the ATO may disclose your debt information to Credit Reporting organisations.

Businesses should note that this is a new initiative from the Government as this information has not been previously disclosed.

Initially, this initiative will only apply to businesses that have:

- An Australian Business Number (ABN); and

- A tax debt exceeding $10,000; and

- Where this debt is at least 90 days overdue.

The disclosure will be made to Credit Reporting Bureaus and could seriously impact on a business’s credit rating thereby making credit either harder to get and/or at higher interest and more restricted terms.

Clearly the ATO is concerned with the time businesses are taking to pay off their debt. This is not an unreasonable step from the ATO and is consistent with what Balanix Solutions has seen in relation to businesses where they have had issues paying ATO debt.

Balanix Solutions always recommends business owners should engage with the ATO to try and resolve debt issues e.g. setting up a payment plan. In the first instance the business owner should talk to their accountant to seek advice and then either have their accountant approach the ATO on their behalf or if they feel confident enough approach the ATO themselves.

If a business owner is having ongoing issues with ATO debt, then there is more likely to be a bigger issue than some short-term cash-flow problems and the business owner should engage their accountant to assist in firstly determining the cause of the problem and then secondly developing a strategy to correct the problem/s.

One thing we know for certain is that if you ignore outstanding debts whether they are to the ATO or some other creditor the problem will only escalate and become bigger. The sooner a you face the issue/s the more likely that the issue/s will be resolved in a satisfactory manner to all parties.

If you have any questions in relation to this information, call Balanix Solutions today on 07 3264 4783.

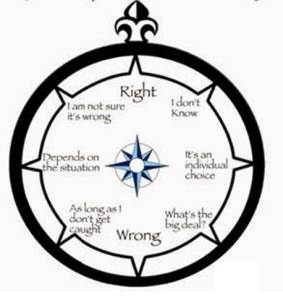

Moral Compass and Taxation

Moral Compass program on the ABC (28 June 2015) focused on taxation in Australia. A lot the discussion evolved around tax planning and tax evasion.

Moral Compass program on the ABC (28 June 2015) focused on taxation in Australia. A lot the discussion evolved around tax planning and tax evasion.

Airing as part of the discussion was a replay of Kerry Packer fronting a Government Senate Inquiry into the Print Media where he made the comments:

“I don’t know anybody that doesn’t minimise their tax,” Mr Packer growled as he stirred his delicate parliamentary china cup of tea with a teaspoon. “I’m not evading tax in any way shape or form. Of course I’m minimising my tax. If anybody in this country doesn’t minimise their tax they want their head read. As a government I can tell you you’re not spending it that well that we should be paying extra.”

Professor Fred Hilmer also made comment on what Bill Gates had to say last year:

“I am happy to pay the tax but unless all competitors are treated equally by the tax system for me to make voluntary tax payments would I think prejudice the success of Microsoft”.

One of the questions you have to ask is why the legislation is so long and complicated and who does this serve? Part of the answer lies in the very people who the Government alleges is taking an unfair/ethical advantage of it. But a large part of the problem is that it is the government’s legislation not corporate Australia’s that allows companies to pay little or no tax relative to their profits.

We would all like to see legislation that is simple effective and applied having regard to the long term future of this country rather than shoring up the political chances of the government of the day at the next election. Likewise, the opposition government has a role to play in supporting positive outcomes for all Australians and not being negative to all proposals.

The taxation system is not a social welfare system but rather a system which should be designed to raise sufficient taxes to enable a government to undertake its long strategies for the country. Mark Carnegie who is a Venture Capitalist and Philanthropist made the point that “the tax system should be a simple system with no loopholes”. Something I totally agree with and I believe would go a long way to resolving a lot of the current issues.

If we believe as a country that certain people within our society need care then the funding of that care should be dealt with through legislation outside the taxation legislation. The inclusion of social issues within the taxation legislation is what leads to many of the complexities which allows the alleged avoidance in the first place.

And until such time as Parliament maker the effort to simplify the tax regime these issues will remain and Kerry Packer’s comments are still as relevant today as they were 24 years ago. This is not an issue just for the Government of the day because without by-partisan cooperation by all members of Parliament looking to the long-term benefit of Australia this will not be achieved and we will be making the same comments in another 25 years.

Have the Scandinavian countries got the answer by publishing everyone’s tax returns so that the process is totally transparent.

Balanix Solutions – Taxation | Accounting | Business Advise.

Situated in Strathpine on Brisbane North, we partner with our clients to assist them in their accounting, business management and bookkeeping needs. Our clients vary in industries from professional services (such as law, vet and dentist) to the trades (mechanic, bricklaying, plasterer etc), hospitality and retail. Are clients are located in the Pine Rivers area (including Brendale, Lawnton, Albany Creek and Eatons Hill) through to Kallangur, Petrie, North Lakes and Caboolture, as well as Brisbane South, the Gold Coast and various other parts of Queensland.

Call us today … we can help (07 3264 4783)