Lawnton

How Becoming Unattached Helps Us Achieve What We Want

If you had a thousand pumpkins seeds and you kept all of them and did nothing with them, how many will you finish up with?

If you had a thousand pumpkins seeds and you kept all of them and did nothing with them, how many will you finish up with?

Now, if you plant ten of those thousand pumpkin seeds, they grow and produce pumpkins, how many pumpkin seeds will you finish up with?

By becoming unattached from the thousand seeds you would be able to achieve more – right!

Now think of this concept in relation to referrals to grow your business. If you and colleagues / business networks approach giving referrals with no other expectations other than giving the referral, overtime you will receive referrals. That is, let yourself become unattached from referrals and if everyone else takes the same approach, then everyone should receive.

To explain this a bit more, let’s assume that there are 20 members in attendance at your regular networking group and everyone chose only to refer if they received a referral back, how many referrals would you expect to be given. I’d suggest not many – if any.

Yet if everyone all approach referral giving with no attachment to receiving a referral I suggest there would be at least 20 referrals given within the group. That is, group members would be receiving referrals even though they had no expectation of receiving them.

Ok, it does not mean that each meeting every member receives a referral, however, it does mean that everyone is in the mind set of giving referrals rather than the expectation of receiving – and it will be everyone’s turn to receive at some point.

What the becoming unattached does is frees up our capacity to refer by removing barriers that prevent us from referring. If I were to remain attached to my referrals, how can I ever be sure that if I give a referral I will get one back? I can’t, however, why would anyone want to give me a referral if they held the same attachment to theirs.

Giving referrals without attachment builds trust between colleagues / network partners, promotes the willingness to refer and contributes to creating long-term relationships.

If you want more of something, try giving some of it away.

Balanix Solutions – Taxation | Accounting | Business Advice.

Situated in Strathpine on Brisbane North, we partner with our clients to assist them in their accounting, business management and bookkeeping needs. Our clients vary in industries from professional services (such as law, vet and dentist) to the trades (mechanic, bricklaying, plasterer etc), hospitality and retail. Are clients are located in the Pine Rivers area (including Brendale, Lawnton, Albany Creek and Eatons Hill) through to Kallangur, Petrie, North Lakes and Caboolture, as well as Brisbane South, the Gold Coast and various other parts of Queensland.

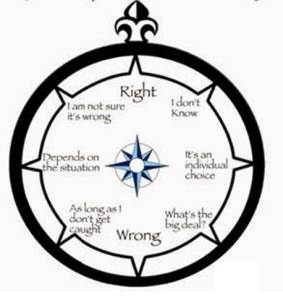

Moral Compass and Taxation

Moral Compass program on the ABC (28 June 2015) focused on taxation in Australia. A lot the discussion evolved around tax planning and tax evasion.

Moral Compass program on the ABC (28 June 2015) focused on taxation in Australia. A lot the discussion evolved around tax planning and tax evasion.

Airing as part of the discussion was a replay of Kerry Packer fronting a Government Senate Inquiry into the Print Media where he made the comments:

“I don’t know anybody that doesn’t minimise their tax,” Mr Packer growled as he stirred his delicate parliamentary china cup of tea with a teaspoon. “I’m not evading tax in any way shape or form. Of course I’m minimising my tax. If anybody in this country doesn’t minimise their tax they want their head read. As a government I can tell you you’re not spending it that well that we should be paying extra.”

Professor Fred Hilmer also made comment on what Bill Gates had to say last year:

“I am happy to pay the tax but unless all competitors are treated equally by the tax system for me to make voluntary tax payments would I think prejudice the success of Microsoft”.

One of the questions you have to ask is why the legislation is so long and complicated and who does this serve? Part of the answer lies in the very people who the Government alleges is taking an unfair/ethical advantage of it. But a large part of the problem is that it is the government’s legislation not corporate Australia’s that allows companies to pay little or no tax relative to their profits.

We would all like to see legislation that is simple effective and applied having regard to the long term future of this country rather than shoring up the political chances of the government of the day at the next election. Likewise, the opposition government has a role to play in supporting positive outcomes for all Australians and not being negative to all proposals.

The taxation system is not a social welfare system but rather a system which should be designed to raise sufficient taxes to enable a government to undertake its long strategies for the country. Mark Carnegie who is a Venture Capitalist and Philanthropist made the point that “the tax system should be a simple system with no loopholes”. Something I totally agree with and I believe would go a long way to resolving a lot of the current issues.

If we believe as a country that certain people within our society need care then the funding of that care should be dealt with through legislation outside the taxation legislation. The inclusion of social issues within the taxation legislation is what leads to many of the complexities which allows the alleged avoidance in the first place.

And until such time as Parliament maker the effort to simplify the tax regime these issues will remain and Kerry Packer’s comments are still as relevant today as they were 24 years ago. This is not an issue just for the Government of the day because without by-partisan cooperation by all members of Parliament looking to the long-term benefit of Australia this will not be achieved and we will be making the same comments in another 25 years.

Have the Scandinavian countries got the answer by publishing everyone’s tax returns so that the process is totally transparent.

Balanix Solutions – Taxation | Accounting | Business Advise.

Situated in Strathpine on Brisbane North, we partner with our clients to assist them in their accounting, business management and bookkeeping needs. Our clients vary in industries from professional services (such as law, vet and dentist) to the trades (mechanic, bricklaying, plasterer etc), hospitality and retail. Are clients are located in the Pine Rivers area (including Brendale, Lawnton, Albany Creek and Eatons Hill) through to Kallangur, Petrie, North Lakes and Caboolture, as well as Brisbane South, the Gold Coast and various other parts of Queensland.

Call us today … we can help (07 3264 4783)

Media-Press “Pine Rivers Press – 11 June 2015” – Strathpine’s Main Strip Misses Out on Upgrade Again

Lach Thompson and Bernie Dowling report in their article “Strathpine’s Main Strip Misses Out on Upgrade Again” (Pine Rivers Press – 11 June 2015) that the plans to fix Strathpine’s main strip have been mothballed with the Moreton Bay Regional Council instead choosing to focus on plans to bring a university to Petrie.

As many Pine Rivers / Strathpine community members would know, the strip was to benefit from the Strathpine 2031 Masterplan and the Gateway Project.

David Balwin from Balanix Solutions commented in the article that traffic problems and poor shop-front exposure were two issues the council needed to take action on. “At the end of the day, both business owners and council benefit if we have a healthy working environment here” David said.

Read the full article here –

Balanix Solutions – Taxation | Accounting | Business Advise.

Situated in Strathpine on Brisbane North, we partner with our clients to assist them in their accounting, business management and bookkeeping needs. Our clients vary in industries from professional services (such as law, vet and dentist) to the trades (mechanic, bricklaying, plasterer etc), hospitality and retail. Are clients are located in the Pine Rivers area (including Brendale, Lawnton, Albany Creek and Eatons Hill) through to Kallangur, Petrie, North Lakes and Caboolture, as well as Brisbane South, the Gold Coast and various other parts of Queensland.

Call us today … we can help (07 3264 4783)

Business Planning – What Do We Include and How Does It Look

Caring Cottage Vision Board

In a previous blog, business owners who are members of the Albany Creek Business Contacts discussed whether businesses really need to undertake business planning (“We Know We Should, So Why Then Don’t We?” https://balanixsolutions.com.au/we-know-we-should-so-why-then-dont-we/ ). It was agreed that businesses did need plans and that business planning needed to be more than just “in our head”. However, it was also agreed that business planning and plans could take various forms with various detail to support and meet the needs of the individual business.

So, what do business owners believe are the critical information to be contained in plans and what can they look like?

In relation to content, the following was proposed:

- Real and enduring purpose – this needs to be clearly stated so every decision you make must support this purpose.

- Stakeholder analysis – stakeholders include clients, suppliers, owners and staff.

- Marketing/Advertising/Sponsorship plan.

- Cashflow/Budget/Revenue & Expense analysis.

- Risk Management/Contingency Plan

- Pricing/Price Structure (eg, current pricing and planning for future increase)

- Staff – roles/nature of employment (eg, part-time, full-time, contract etc)

- Responsibilities and timeframes – ie, who is going to do what by when.

So what does the Business Plan need to look like? Well, in a nutshell – whatever suits you and your business, that you are going to use – whatever makes it visible!

Whenever business planning is mentioned images of 50+ page documents, which sit in a draw, never get used and collect dust, emerge. But this doesn’t have to be – they can take whatever form that makes sense to a business owner and enables them to run and grow their business. Suggested mediums that business use include:

- Vision Boards (like the one Kirsty has above)

- Operational Boards – eg, Marketing Board, Operations Board, IT Board etc

- Notebook

- iPad/Tablet/Phone

- Mind Map

- Whiteboard

The thing is successful businesses need to have direction and plans. However, those plans need to support the business not hinder.

(Blog contributors – Leonard Whittaker (Action Cycle Learning) Rob Carmody (Australian Integrated Communications) Sally Balwin (Balanix Solutions) Kathy Patterson (Brendale Stationery Supplies) Matthew Fox (Brisbane hosting & Web Design) Kirsty Newbery (Caring Cottage) Brad Davies (Conquest Pest & Termite Control) Scott Deaves (David Deane Real Estate) De Wet van der Nest (Express Air Con Cleaning) Oriano Giammichele (GT Racing, Mobile Mechanic) Stuart Bywater (Bywater Design) Rhennen Ford (Streten Mason Lawyers) Tracey Carter (Scrub Mutts) Jason Matthey (Insurance Web) Damien Jenkins (Australian Unity, North Lakes) Anne-Louise Underwood (SMS Toolkits) Bruce Hall (Wombat Electrical)

Albany Creek Business Contacts consists of local quality and reliable businesses who provide a wide range of services from home and residential services to B2B and commercial services. Our service areas cover primarily Albany Creek, Eatons Hill, Brendale, Aspley, Warner, Chermside, Strathpine, North Lakes. However many members will cover greater areas.

Albany Creek Business Contacts meet fortnightly on a Wednesday morning for a 7am breakfast and networking meeting.

Balanix Solutions – Taxation | Accounting | Business Advise.

Situated in Strathpine on Brisbane North, we partner with our clients to assist them in their accounting, business management and bookkeeping needs. Our clients vary in industries from professional services (such as law, vet and dentist) to the trades (mechanic, bricklaying, plasterer etc), hospitality and retail. Are clients are located in the Pine Rivers area (including Brendale, Lawnton, Albany Creek and Eatons Hill) through to Kallangur, Petrie, North Lakes and Caboolture, as well as Brisbane South, the Gold Coast and various other parts of Queensland.

Call us today … we can help (07 3264 4783)

Family Assistance Payments – 2014 Year

Time is rapidly running out for those taxpayers who wish to claim family assistance payments for the 2014 financial year. These claims must be lodged with the Department of Human Resources (Centrelink) by the 30 June 2015.

Time is rapidly running out for those taxpayers who wish to claim family assistance payments for the 2014 financial year. These claims must be lodged with the Department of Human Resources (Centrelink) by the 30 June 2015.

The 30 June 2015 deadline relates to claims for Family Tax Benefit, Child Care Benefit and Single Family Supplement.

A prerequisite for making this claim is that your 2014 Individual tax return has been lodged by 30 June 2015.

If you or your partner don’t need to lodge a tax return, you need to tell Centrelink and confirm your income for the year. The quickest and easiest way to do this is using your Centrelink online account through myGov, the Express Plus Centrelink mobile app or your One Time Access Code.

In some situations, Centrelink won’t be able to accept your advice that you or your partner don’t need to lodge a tax return. This will happen for example, where you or your partner:

- had a taxable income above the tax free threshold

- were entitled to receive, or had to pay child support

- had an interest in a business or were self-employed

- had tax withheld from your payment or income, or

- had reportable fringe benefits or reportable superannuation contributions

Note the lodging of the individual tax return is a separate issue from making a claim for family assistance therefore individuals can lodge their claim for family assistance prior to lodging or finalizing their individual tax return.

It is important to remember that while it is possible to get an extension past 30 June for tax lodgement these extensions are not taken into account by Centrelink in terms of the 30 June deadline. In other words for Centrelink purposes there is no extension beyond 30 June 2015 if you wish to claim Family Assistance for the 2014 financial year.

Should you need any assistance in completing your 2014 tax return, call Balanix Solutions on 33244788.

The Family Assistance form can be either downloaded from the Centrelink website or completed online.

Balanix Solutions – Taxation | Accounting | Business Advise.

Situated in Strathpine on Brisbane North, we partner with our clients to assist them in their accounting, business management and bookkeeping needs. Our clients vary in industries from professional services (such as law, vet and dentist) to the trades (mechanic, bricklaying, plasterer etc), hospitality and retail. Are clients are located in the Pine Rivers area (including Brendale, Lawnton, Albany Creek and Eatons Hill) through to Kallangur, Petrie, North Lakes and Caboolture, as well as Brisbane South, the Gold Coast and various other parts of Queensland.

Call us today … we can help (07 3264 4783)