Tax

Investment In Property Seminar 14 July 2015

Here are the highlights from the “Investment In Property” seminar, Balanix Solutions presented at, held on 14 July 2015 in Caboolture (click on picture below).

Balanix Solutions, along with co-presenters are looking to run these seminars 3-4 times a year in Caboolture as well as other locations in the Moreton Bay Regional area. If you are interested in attending any in the future seminars, please register your interest here – REGISTER INTEREST

div style=”clear:both;”>

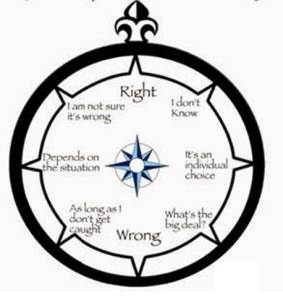

Moral Compass and Taxation

Moral Compass program on the ABC (28 June 2015) focused on taxation in Australia. A lot the discussion evolved around tax planning and tax evasion.

Moral Compass program on the ABC (28 June 2015) focused on taxation in Australia. A lot the discussion evolved around tax planning and tax evasion.

Airing as part of the discussion was a replay of Kerry Packer fronting a Government Senate Inquiry into the Print Media where he made the comments:

“I don’t know anybody that doesn’t minimise their tax,” Mr Packer growled as he stirred his delicate parliamentary china cup of tea with a teaspoon. “I’m not evading tax in any way shape or form. Of course I’m minimising my tax. If anybody in this country doesn’t minimise their tax they want their head read. As a government I can tell you you’re not spending it that well that we should be paying extra.”

Professor Fred Hilmer also made comment on what Bill Gates had to say last year:

“I am happy to pay the tax but unless all competitors are treated equally by the tax system for me to make voluntary tax payments would I think prejudice the success of Microsoft”.

One of the questions you have to ask is why the legislation is so long and complicated and who does this serve? Part of the answer lies in the very people who the Government alleges is taking an unfair/ethical advantage of it. But a large part of the problem is that it is the government’s legislation not corporate Australia’s that allows companies to pay little or no tax relative to their profits.

We would all like to see legislation that is simple effective and applied having regard to the long term future of this country rather than shoring up the political chances of the government of the day at the next election. Likewise, the opposition government has a role to play in supporting positive outcomes for all Australians and not being negative to all proposals.

The taxation system is not a social welfare system but rather a system which should be designed to raise sufficient taxes to enable a government to undertake its long strategies for the country. Mark Carnegie who is a Venture Capitalist and Philanthropist made the point that “the tax system should be a simple system with no loopholes”. Something I totally agree with and I believe would go a long way to resolving a lot of the current issues.

If we believe as a country that certain people within our society need care then the funding of that care should be dealt with through legislation outside the taxation legislation. The inclusion of social issues within the taxation legislation is what leads to many of the complexities which allows the alleged avoidance in the first place.

And until such time as Parliament maker the effort to simplify the tax regime these issues will remain and Kerry Packer’s comments are still as relevant today as they were 24 years ago. This is not an issue just for the Government of the day because without by-partisan cooperation by all members of Parliament looking to the long-term benefit of Australia this will not be achieved and we will be making the same comments in another 25 years.

Have the Scandinavian countries got the answer by publishing everyone’s tax returns so that the process is totally transparent.

Balanix Solutions – Taxation | Accounting | Business Advise.

Situated in Strathpine on Brisbane North, we partner with our clients to assist them in their accounting, business management and bookkeeping needs. Our clients vary in industries from professional services (such as law, vet and dentist) to the trades (mechanic, bricklaying, plasterer etc), hospitality and retail. Are clients are located in the Pine Rivers area (including Brendale, Lawnton, Albany Creek and Eatons Hill) through to Kallangur, Petrie, North Lakes and Caboolture, as well as Brisbane South, the Gold Coast and various other parts of Queensland.

Call us today … we can help (07 3264 4783)

Family Assistance Payments – 2014 Year

Time is rapidly running out for those taxpayers who wish to claim family assistance payments for the 2014 financial year. These claims must be lodged with the Department of Human Resources (Centrelink) by the 30 June 2015.

Time is rapidly running out for those taxpayers who wish to claim family assistance payments for the 2014 financial year. These claims must be lodged with the Department of Human Resources (Centrelink) by the 30 June 2015.

The 30 June 2015 deadline relates to claims for Family Tax Benefit, Child Care Benefit and Single Family Supplement.

A prerequisite for making this claim is that your 2014 Individual tax return has been lodged by 30 June 2015.

If you or your partner don’t need to lodge a tax return, you need to tell Centrelink and confirm your income for the year. The quickest and easiest way to do this is using your Centrelink online account through myGov, the Express Plus Centrelink mobile app or your One Time Access Code.

In some situations, Centrelink won’t be able to accept your advice that you or your partner don’t need to lodge a tax return. This will happen for example, where you or your partner:

- had a taxable income above the tax free threshold

- were entitled to receive, or had to pay child support

- had an interest in a business or were self-employed

- had tax withheld from your payment or income, or

- had reportable fringe benefits or reportable superannuation contributions

Note the lodging of the individual tax return is a separate issue from making a claim for family assistance therefore individuals can lodge their claim for family assistance prior to lodging or finalizing their individual tax return.

It is important to remember that while it is possible to get an extension past 30 June for tax lodgement these extensions are not taken into account by Centrelink in terms of the 30 June deadline. In other words for Centrelink purposes there is no extension beyond 30 June 2015 if you wish to claim Family Assistance for the 2014 financial year.

Should you need any assistance in completing your 2014 tax return, call Balanix Solutions on 33244788.

The Family Assistance form can be either downloaded from the Centrelink website or completed online.

Balanix Solutions – Taxation | Accounting | Business Advise.

Situated in Strathpine on Brisbane North, we partner with our clients to assist them in their accounting, business management and bookkeeping needs. Our clients vary in industries from professional services (such as law, vet and dentist) to the trades (mechanic, bricklaying, plasterer etc), hospitality and retail. Are clients are located in the Pine Rivers area (including Brendale, Lawnton, Albany Creek and Eatons Hill) through to Kallangur, Petrie, North Lakes and Caboolture, as well as Brisbane South, the Gold Coast and various other parts of Queensland.

Call us today … we can help (07 3264 4783)

Is Your Investment Property Loan a Mixed Loan?

If you currently have an investment property or are looking to buy one and you have or will be borrowing money to fund the investment read on.

If you currently have an investment property or are looking to buy one and you have or will be borrowing money to fund the investment read on.

Sometimes investors get themselves into trouble by mixing up loans such that the loan has a private as well as an investment component. Where you borrow money to produce assessable income as buying a rental property then in most cases the interest associated with the borrowing will be deductible.

However, if you at some future stage decide to do a redraw on these funds and the redraw is not for the purposes of producing assessable income then you end up with what is referred to as a “mixed loan”.

An example of how this might happen is when Mr Jones takes out a $300,000 loan to purchase an investment property which he then rents out at the going weekly rental for the area where he purchased the rental property. A year after taking out the loan Mr Jones inherits $100,000 from his deceased uncle’s estate. Mr Jones then decides to pay down the investment loan with the $100,000 from the inheritance. Some months later Mr Jones decides to go on an extended overseas holiday and redraws $30,000 from the $100,000 he used to pay down the investment loan.

We now have what is referred to as a mixed loan. This can have significant tax implications going forward. If you pounce on this issue quickly then the problem can be resolved at a minimum cost, however, if left unresolved for a number of years and there are further redraws the problem can involve significant cost to resolve or worse, if the ATO conduct an audit with the potential of interest and penalties payments.

If you have an investment property and you have done a redraw we would encourage you to call us and check whether you have a potential issue. We can normally identify if there is a potential issue with minimum cost.

Should it be the case that there is an issue we will work with you to resolve the issue giving you confidence that you will not face an unwanted problem going forward.

The information in this blog is general in nature and should not be acted or relied upon. If you have concerns or are about to take out an investment loan you should seek professional tax advice in relation to the potential tax issues of such loans.

Balanix Solutions – Taxation | Accounting | Business Advice.

Situated in Strathpine on Brisbane North, we partner with our clients to assist them in their accounting, business management and bookkeeping needs. Our clients vary in industries from professional services (such as law, vet and dentist) to the trades (mechanic, bricklaying, plasterer etc), hospitality and retail. Are clients are located in the Pine Rivers area (including Brendale, Lawnton, Albany Creek and Eatons Hill) through to Kallangur, Petrie, North Lakes and Caboolture, as well as Brisbane South, the Gold Coast and various other parts of Queensland.

Changes to Fuel Tax Credits

The Australian Taxation Office (ATO) has increased the Fuel Tax Credit Rates from 10 November 2014. Further these rates will now be indexed on 1 February and 1August each year in line with the Consumer Price Index.

The Australian Taxation Office (ATO) has increased the Fuel Tax Credit Rates from 10 November 2014. Further these rates will now be indexed on 1 February and 1August each year in line with the Consumer Price Index.

So, if you claim the credit you need to make sure you are using the correct rates.

If you happen to do your BAS monthly and have already done November’s don’t panic – you can still make an adjustment. If you are not sure how to do this speak to us and we will guide you in how to make the adjustment.

If you are not claiming the credits but you use machinery, plant, equipment or heavy vehicles in your business you may be eligible for the Fuel Tax Credit. How do you know if you maybe eligible – well the starting point is determining which fuels are eligible.

Eligible fuels include petrol, diesel, kerosene, mineral turpentine, white spirit, toluene, heating oil and most solvents.

Fuels which are not eligible include aviation fuel, fuel used in light vehicles of 4.5 tonnes gross vehicle mass or less which travel on public roads, fuel that you have purchased but has been stolen, lost or otherwise disposed of and lastly some alternative fuels which have already received a grant or subsidy.

So how do I go about making a claim?

The first thing you need to do is to be registered for both GST and Fuel Tax Credits. Once you are properly registered the Fuel Tax Credit will appear on your BAS.

Please note the Fuel Tax Credits are part of your business income and therefore needs to be included on your tax return.

In addition, should you be using a heavy diesel vehicle manufactured before 1 January 1996 you may also meet some environmental criteria as well.

Like everything in business, you should seek professional advice for your particular circumstances. If you are interested to find out more and discuss if this applies to you, call us today – we can –help (3264 4783).

Balanix Solutions – Taxation | Accounting | Business Advice.

Situated in Strathpine on Brisbane North, we partner with our clients to assist them in their accounting, business management and bookkeeping needs. Our clients vary in industries from professional services (such as law, vet and dentist) to the trades (mechanic, bricklaying, plasterer etc), hospitality and retail. Are clients are located in the Pine Rivers area (including Brendale, Lawnton, Albany Creek and Eatons Hill) through to Kallangur, Petrie, North Lakes and Caboolture, as well as Brisbane South, the Gold Coast and various other parts of Queensland.

Call us today … we can help (07 3264 4783)